Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

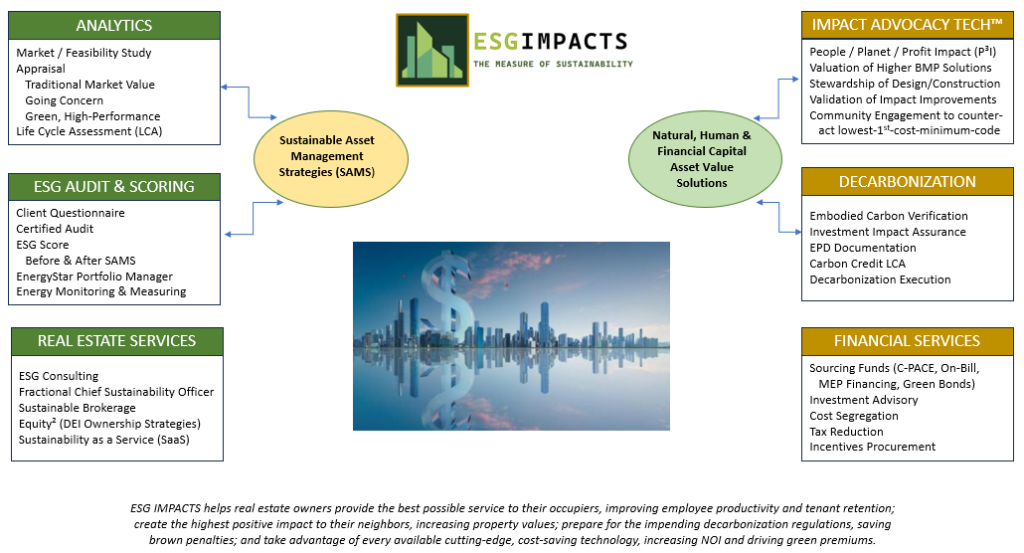

Best practice is, by definition, past practice. Welcome to ESG IMPACTS, a sustainable real estate services firm leading ESG markets into the future as profit centers.

With offices in Washington DC and Houston TX, and strategic operating partners networked across the country, our data-integrated products and services are forward-looking, global facing, and locally implemented.

Using our proprietary Impact Advocacy Tech™ to conceptualize and engineer excellence and highest asset value in the built environment through proven and innovative sustainable best practice designs, technologies, and policies.

Supporting acquisitions, operations, and dispositions through sustainable decision-ready due diligence: helping buyers to understand the future costs and benefits of environmental and social requirements they will be subject to, sellers with value maximization exit strategies, owners and tenants with Green Leases, and matching sustainable and impact buyers and sellers.

Collaborating on ESG metrics in real estate with the Mortgage Bankers Association and the secondary markets (Fannie and Freddie), as well as with the real estate schools and innovation labs at various colleges and universities, to institutionalize methodologies, protocols, and expectations.

ESG IMPACTS has the great pleasure of working every day on solving the real estate aspects of two of the biggest problems of our time: global warming and social equity.

We have already created some of the new best practices in this new paradigm, and our clients increasingly benefit from our forward-looking monetization of ESG as a profit center and as an asset class.

ESG IMPACTS and its partner companies – McMac CX, Enterprise Real Estate, and The E³SG Companies:

Have already verified the sustainability of one million square feet of mixed use, office, and industrial real estate assets through their newly introduced proprietary ESG scoring models, thus validating the inclusion of those assets in Green Fund syndications.

Is defining ESG as an asset class.

Has built innovative systems around the “G”, recognizing that the governance of real estate is government, through its powers of zoning, comprehensive planning, building codes, etc. Further, each of the ± 2.2 million government buildings across the country provides an incredibly important stabilizing or regenerative socio-economic force in their respective neighborhoods.

Has a history of successfully adding value to real estate. As spaces are decarbonized, and made healthier and more productive, tenants are willing to pay a premium. Utility expense is reduced through energy efficiency. As a result of higher rents and lower operating expenses, net operating income is increased. By reducing leasing, operating and disposition risks, cap rates and yield rates are lower, and the resultant values are higher.

Has developed the first and only peer reviewed methodologies to validate the value of carbon credits in commercial real estate. Real estate owners now have access to a new revenue stream and/or tax benefit.

Is currently a key part of several major project development teams across the country, starting with site acquisition, continuing with the recommendation, validation and valuation of various green and sustainable strategies, assisting with green bond financing, concluding with ESG consulting for building construction and occupancy.

Has systems and analyses, and assurance services, that solve for greenwashing.

Has created and leads a national ESG Audit Network to provide boots on the ground inspection and analysis of properties being audited, scored, valued, or monitored.

Is in position to support: 1) property owners, as the Securities and Exchange Commission and local ordinances, such as Local Law 97 in New York, begin to regulate carbon emissions and ESG claims, and 2) companies, representing more than 90% of global GDP, that have pledged to transition to net-zero emissions. Our work already meets the new rules requiring standardization and increased transparency, integrity, and compliance. Our auditing, monitoring, and reporting functions will be at the heart of the process. Our ESG scores and values are a natural byproduct for the benefit of shareholders and stakeholders.

Is reimagining Diversity, Equity and Inclusion (DE&I) as Equity², taking ESG out of the boardroom as a talking point and moving it into the real estate markets, creating real equity opportunities for under-represented populations.

Has connected high conviction Impact to ESG. Impact is one of the measures of ESG scoring. In real estate, ESG and Impact are integrally linked.

Has created Sustainability as a Service (SaaS), acting as a Fractional Chief Sustainability Officer for smaller corporates, infusing ESG and sustainability throughout a company and managing all the reporting requirements.

Is promoting widespread adoption of shared ESG data elements across multiple industries – brokerage, appraisal, mortgage lending, MBS / Green Bonds – and thereby connecting ESG real estate to the Circular Economy

First, many of our clients have been with one of the three partners for over 30 years. These are the known relationships. They are property owners of different classifications or other professionals with whom we have a partner, team or referral relationship. We will continue to provide the services we always have, but now have the capacity to offer the full ESG scope of services.

The second category includes all those who have an interest in ESG, green, high performance, sustainable, and social impact real estate. This is an evolving marketplace, pressured by shareholder mandates and new regulations, and they value our new, first-in-kind scoring metrics, valuation methodologies, and our ESG Audit Network. These are large and medium size corporations, institutional owners and asset managers; family offices and high net worth individuals; and social impact investors. Smaller companies use us on a consulting basis as asset managers and as fractional sustainability offices.

Third are those services related to carbon and/or energy efficiency. These include quantification and life cycle assessment, assurance and validation, and decarbonization. Clients tend to be real estate investors and developers, tech companies and consultants for building energy audits, energy services performance contractors, or prop tech. On the Voluntary Carbon Market (VCM) side, clients include carbon removals, direct air capture projects, CCSUS projects - project developers, major carbon auction exchange operators, etc., carbon technology firms, and carbon traders.

Fourth revolves around the data. For Cherre and their vendor partners, ESG IMPACTS provides the ESG component of the data kits sold to their Fortune 500 client list.

As a result of these client relationships, and the accumulated learning and data, ESG IMPACTS will be among the national leaders in standardizing ESG. We will therefore further our relationships with the mortgage lending community – the Mortgage Bankers Association (MISMO) and the GSE’s including Fannie and Freddie – and the college and university systems – particularly those with real estate, engineering, and architecture schools (and their students can be a paid part of our ESG Audit Network).

Founder / President, McMac CX, the inventor, global aggregator, and deployment pathway for Impact Advocacy Tech (IAT), solving immediate institutionalized issues limiting the social, environmental, and financial cost benefits of designs, construction, and operations of our Built Environment while simultaneously laying the foundation for long-term behavior and policy changes. IAT gives equal access to solutions that create safe, healthy, efficient, and prosperous places for everyone to live, learn, work, and play.

Co-Founder, Texas Sustainable Business Network ; Chair, USGBC Texas Best Practices Committee; Captain, Royal Canadian Horse Artillery, Retired.

Founder / President, Enterprise Real Estate Advisors, a professional Houston Commercial Real Estate firm specializing in leasing, managing and operating commercial real estate investments for various owners. He has directed leasing and asset management teams for several well-known commercial real estate companies with large portfolios of assets and has developed an excellent reputation for negotiations, deal structuring, marketing and business development, built on integrity and excellent service.

He has advised major corporations, institutions and international clients as well as hundreds of entrepreneurial business owners involving over 100 various commercial projects throughout Texas. He has successfully negotiated nearly 2,000 leasing and sales transactions with an aggregate value exceeding $500 million.

Founder and CEO of The E³SG Companies, purpose-driven innovators and creators of ESG applications in real estate, delivered through synergistic technology, education and brokerage partnerships.

Owner, Managing Director and Senior Advisor of the Chesapeake office of SVN-Miller Commercial Real Estate and National Chair ǀ ESG and Impact Investing for SVN International Corp. ; President of The Greenlee Group, an asset management, valuation, and economic consulting firm.

He has been an advocate for the integration of best sustainability practices in the economics of investment real estate throughout his 35-year career, focusing on Sustainable – Impact – and ESG Investing, Conservation, Revitalization, Place Making, Value Enhancement, Funding Solutions, Property Management, and Economic Research.

ESG IMPACTS’ impact models define, measure, manage, and report social, health and environmental performance in the following select categories. Users are able to measure similar impact investments against one another, thus enabling ESG and Impact investors to determine which impact categories they are most interested in.

Aggregates advanced global hands-on and technical solutions that predict, steward, and assure the Natural, Human, and Financial capital asset value potential possible through deployment of proven-sustainable-best-practice designs, technologies, and policies.

We help property owners create a competitive advantage for their assets by leveraging data, innovative technologies and financial resources resulting in increased cash flow, property value, desirability and community impact.

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

Not sure where to start? Use the form below to send us your question or opportunity and we'll get back to you.

Have led the commissioning (LEED, EnergyStar) of over five million square feet of real estate on behalf of several of the nation’s highest caliber, most respected corporate and institutional owners and their contractors, architects, and design consulting firms.